Gone are the days where customers were happy with only a waiver on late-payment fees. While everyone enjoys freebies, they don’t always translate to increased assets under management or loyal customers. That said, taking an iron-fist approach with profits to please the board can cause an enterprise to fall from grace with customers.

How BFSI Marketing Teams can find the Right Balance

Enterprises are aware of this friction. Businesses need profit, and the management is accountable for investors’ money. Customers, on the other hand, expect to be pampered. BFSI enterprises are having trouble finding the right balance. They generally take one of two approaches:

1. Top-Down: With this approach, the business goals and targets are set from above. Sales and marketing divisions are tasked to achieve these goals, and customer experience can take the back seat.

2. Bottom-Up: With this approach, CSAT scores and customer priorities take the front seat. Key result areas are generally tied to sales without accounting for costs. These companies are busy acquiring customers and keeping them happy while profitability takes a back seat.

That said, banks—like most companies—must find ways to balance these two approaches. Here are a few ways to find that balance:

1. Make both “customers interests” and “enterprise objectives” CMO/CSO priorities.

Enterprises should discover the whys behind customers engaging with their brand. They should nudge those customers toward their individual goals using the enterprise’s product offerings and experiences. In doing so, they can’t assume an infinite supply of resources or cash. The products and discounts—including any freebies and vouchers—should be rationed from a pre-allocated budget.

For example, when John visits a bank’s website and clicks a few times around the 8PC_Personal_Loan_1Y product, he shouldn’t be incessantly nudged toward signing up for that product. The bank must first establish a connection with John’s underlying purpose, which could be “short-term credit need.” After that, the bank should work out the case from John’s perspective, taking into consideration his assets and liabilities, products held, credit rating, etc. Finally, the bank can recommend multiple products that help him realize his purpose, which might include “loan at 2% on top of his deposits.”

When recommending the 2% deposit product to John, sales and marketing should be aware that they may be doing so at the expense of possibly recommending the same to Alice, as there should be a rationed quota of products to sell to achieve the desired profit margins.

2. Build hierarchical journey plans.

Based on the above example, banks must build three kinds of customer journey plans: strategic, tactical and operational.

A. Strategic journeys focus on objectives and verifiable targets but do not specifically talk about means to achieve those targets. They always work on aggregate milestones—not in an individual customer’s context—and may cover multiple objectives.

For example, the bank could lay out the quarterly revenue and sales targets with monthly milestones alongside broad annotations:

Month 1: $2 million investments, 25,000 new product sales

Month 2: $1 million investment

Month 3: $3 million investment, 50,000 product sales

Overall goal: Of the 75K new product sales, at least 50% should be upsell and 30% cross-sell.

B. Tactical journeys are defined in the context of individual customers. They don’t carry a complete prescription of all steps from start to end of the journey, and they can have multiple branches along the way. They are defined on a persona and may delegate orchestration to operational journeys, which are described below.

A good tactical journey caters to a single objective from a strategic journey. The bank could, for example, define the five-months journey for first-time-earner persona. This could include monthly guidance milestones to assess progress at the individual level as well as triggering campaigns at stipulated intervals or in response to certain user activity:

Month 1: Ensure no customer complaints and all KYC are complete.

Month 2: Complete zero-party data survey.

Month 3: Recommend two products based on behavioral and contextual data.

Month 4: Check if the customer has signed up for at least one new product since onboarding.

Month 5: Assign a persona based on portfolio value and take a first guess at CLTV.

3. Operational journeys are largely contextual in nature and do not necessarily align with any specific business objectives. They are reactive in order to provide the best customer experience.

A detailed flow diagram, for example, should be based on personalizing engagements by taking into consideration user clicks, activity and inactivity on the banks’s website and app. In doing so, stitch together user actions across channels—such as KYC completed, responded to surveys, etc.—in order to have holistic context for nudging customers.

4. Implement strategies and adopt technology to achieve business goals.

Once journeys are developed, banks should revitalize the marketing and sales activity to align with the hierarchical journeys above. During this process, the CMO and/or CSO team should define top-level strategies alongside enterprise goals and operational constraints.

Technology plays an important role here. For example, domain specialists and analysts punch in the broad outline of tactical journeys, while technology, such as an ML-backed enterprise marketing tool, can take responsibility for curating the actual operational journeys.

Conclusion

To realize large successful business transformations, BFSI enterprises need to maintain equal focus on CSAT and profits. They need to work out a sales and marketing strategy where enterprises serve as a bridge helping customers meet their personal financial goals without taking blind-folded customer-centricity approaches.

Sound journey planning leveraging on strategical, tactical and operational journeys while empowering teams with technology. Only then can companies find the right balance to serve both customers and investors.

Want to know how Pelatro can help you improve your customer engagement? Get in touch at hello@pelatro.com

Author

Chief Architect at Pelatro. Proud to help 40+ Telcos/BFSIs offer the finest contextual marketing experience to their 1B+ subscribers. Read Pramod Konandur Prabhakar’s full executive profile here.

This article was originally published here.

]]>The spray-and-pray method worked fine during the initial days of digitalization, but it has drastically changed with the advent of big data and AI/ML technologies. Customers demand contextual personalisation and companies want to make it a business priority. It is significant to note, that companies that excel at personalisation generate 40% more revenue than average players.

Today, leading telcos have turned to context-driven personalisation that utilises real-time data and insights to cater to the customer’s current and latent needs with the use of advanced analytics, machine learning, and data management tools.

Dynamic and evolving customers demand contextual and relevant interactions

While earlier customers may have expected basic services such as call quality or network range to be a benchmark, this has changed drastically over the years with a significant paradigm shift happening during the COVID-19 pandemic. Being locked down and stuck indoors, customer expectations have continued to evolve and set ever higher benchmarks with a majority now considering experience to be just as important as products and services.

While we briefly touched upon the transition to context-driven personalisation, there are a couple of specific examples of how companies have evolved with changing customer demands and reinforcing their engagement strategy to ensure they are contextual and relevant.

In Europe, for example, certain operators have been able to develop a next-best-action churn model. This provided them with the ability to measure each customer’s likelihood to leave for a competitor in addition to grading the reasons behind churn. This analysis for customer churn, therefore, helped the operator to create campaigns on a micro-segment level and ensure highly personalised, contextual, and relevant interactions to address specific pain points with particular customers.

Another approach is telecoms that use network optimization techniques and real-time data to identify any potential network issues and preemptively resolve them to avoid any impact on the customer. Take for example a customer who is regularly experiencing slow mobile internet speeds, the operator can use network optimization techniques and tools to identify the issue, find the reason behind it and resolve the pain point resulting in better customer experience in addition to reducing support costs.

Moving from telco-specific services to a more digital services business model by integrating industry-agnostic offerings.

As technology becomes a more standardized approach across the telecommunication industry, the differentiation comes from how efficiently one can utilize it and offer better services through those technologies. Moving away from a telco-only specific model to a more comprehensive digital services portfolio model by integrating with other industries allowed telcos to offer an upgraded value to their customers.

Telecos may also have to reassess their business models, backend processes, and customer care support but when executed efficiently and at scale, these services can be a game-changer. The integration of newer services and products would require telcos to be customer obsessed and aim to drive value by creating a digital ecosystem that offers personalized avatars of the customer journey. Rakuten in Japan is the best example of how an e-commerce giant is revolutionizing the telecom space.

A company may choose to approach this by tracing the customer journey to truly understand their preferences to provide their customer with a differentiated digital experience via a range of digital services, which in turn enhances customer lifetime value. From payment services to music, advertisements and partnerships with other businesses – telcos must aim to pose a unique value proposition by giving their customers an exclusive omnichannel and holistic digital experience. The advent of 5G will further empower telcos in their drive to comprehensively personalise customer journeys, thanks to the inherent advantages of the technology. Benefits such as faster speeds, more reliable connections, increased capacity, and improved analytics, will also enable newer applications such as the use of augmented reality or virtual reality for a more personalised experience for each user.

In essence, with time and appropriate resources, telcos can be a lot like SaaS companies and provide integrated systems that can expand their service portfolios and revenue streams.

Changing the Customer Engagement Process

Without a doubt, there are multiple case studies on the internet (successful and otherwise) showcasing companies starting their digitalization journey by making huge investments in marketing technology. It is imperative to note that with martech, there is hardly ever a one-size-fits-all solution, and the focus should be on drawing value from the technology being adopted.

There are multiple ways to look at this and strategy will likely differ from one company to the next. Some telcos may prefer to adopt new technologies as greenfield projects, i.e., they choose not to digitize legacy systems yet. However, the telcos that have successfully implemented these technologies were able to integrate various distribution channels and avoid data siloes. This would range from accruing data from external and internal channels to providing a holistic picture of the customer with the ability to act on behaviours and needs, thereby personalizing the engagement and touchpoints to customers.

Artificial Intelligence and Machine Learning in Customer Engagement

Maximizing value from the adoption of new technologies while controlling costs or investments is crucial. The implementation of emerging technologies such as artificial intelligence and machine learning are already on the rise by telecommunication companies and have proven to be game-changers. This AI/ML-powered revolution can be seen in the form of chatbots and virtual assistants, personalised marketing via better customer data analysis and customer segmentation, predictive maintenance to reduce disruption to customers, and fraud detection to improve the security of systems. Various large global telecom companies such as AT&T, Verizon, T-Mobile, Vodafone, and Orange have implemented these novel AI/ML-enabled technologies to bring about a paradigm shift in customer engagement.

While many are aware of the implementation of these technologies in the digital customer journey to enhance experience and engagement, it is interesting to note that AI and ML can also be used in the retail/store setting to remove bottlenecks. In addition, these technologies allow for the integration of the ‘digital’ aspects of the company with physical stores and this is combined with personalized advertisements and targeted offers that reach the customer at the right time and when it is most relevant!

Artificial Intelligence and Machine learning technologies are now being used by telecommunication operators to create holistic customer profiles. Furthermore, these operators are now able to automate tedious and repetitive tasks and thereby reduce the burden on their teams while allowing more time for innovation and brainstorming.

For example, Reliance Jio uses AI, predictive analytics and big data to create real-time profiles of its 300+ million users. This gives the operator a better understanding of the market and helped it outperform competitors.

Another large telecom operator, Airtel, in India essentially created a new revenue stream by launching an advertisement service that leveraged its data science expertise and customer data. This operator ran targeted and uber-relevant advertisements from across industries including FMCG, BFSI, Automotive etc. These are some examples of how personalisation can offer new business opportunities to telcos.

Ensuring that the customer’s journey is managed and that the contextual marketing experience is on-point, can go a long way in altering the customer engagement process resulting in greater customer loyalty, enhanced brand power, greater customer retention, higher customer activation, enlarged range of revenue streams and a higher average revenue per user. To get a better understanding of how to elevate your marketing campaign’s performance, check this article here, which showcases the use of emerging technologies like AI/ML to maximize value.

]]>For example, notifying Susan of the newest arrivals at Prada and Jack of those at Bergdorf as they enter Saks Fifth Avenue was once considered innovative. Today’s algorithms do a lot more work, stitching together even more context to determine if Susan and Jack are moving in together. Or, given their common interest in Italian food, the time of day and a dozen other things, maybe they’re heading toward Armani/Ristorante and need the chef’s menu. This is cool, but what if Susan and Jack begin to wonder, “If something I don’t pay for directly can do all of these things, then what should the banker I invest in be doing for me?” Do bankers have a convincing answer?

Personalization at scale, delivering positive experiences and steering customers toward deeper engagements that lead to a higher share of wallet is the need of the hour—even more so in verticals where customers stay invested longer.

Are BFSI and telcos chalk and cheese?

While banking, financial services and insurance (BFSI) and telecommunications companies (“telcos”) have different business priorities, when seen from the customer lifecycle, technical maturity and marketing technology (martech) complexity angles, they are not that different. These are large enterprises offering long-term services to their customers—engagements can easily span several years, if not decades. These enterprises have evolved over time, have stood witness to many tech revolutions (e.g., big data, digital, the cloud), and have rich representation from all of these waves in their IT ecosystem.

Unlike verticals, where lack of data is a big handicap to informed decision making, these enterprises are soaked in data but are largely constrained in their freedom to unleash the full potential due to privacy/consent regulations. They both have millions of customers, hundreds of integrations and billions of events spread across transactional and engagement axes. They are both challenged by newer players, be that neobanks or digital VoIP vendors and risk running into an imminent existential crisis unless they reinvest themselves in their customers’ interests and offer them the most relevant experiences.

Outcome-Driven Mindset

Personalization holds the key to relevance, and enterprises are well aware of that. The most important question is whether their personalization initiatives are outcome-driven or experience-driven. To be successful today, enterprises need to go beyond instant gratification.

Pick a telco company or bank—they likely have a string of models to offer tailored experiences by discovering and aligning to their customers’ preferred channels, time for contact, language and even their preferred products. But do they have a sufficient understanding of the purpose and objectives of every single customer? If they did, why is the phrase “segment of one” so common but not “purpose of one?” Outcomes are not created by chance; they are earned.

The Journey Route

Enterprises need to look beyond customer transactions and connect to the driving force that is holding them onto the brand. What drives each interaction? Rather than looking at customer activities as a loose combination of unrelated events, enterprises need to take a quantitative approach and sequence the events by tying them along the purpose axis.

Over the past week, say Alice has checked for home loans on a bank website, liked the new credit card promotion on the bank’s Facebook page, re-tweeted the bank’s special home loan offer for public servants, downloaded the banking app and paid the utility bills. It’s messy to group all of these interactions over the recency axis and then try to infer the next-best recommendation for Alice.

Martech of the future should be able to recognize the two strands here—one along the home loan axis and another along credit cards—run through her current portfolio, past engagements, collective interactions with the bank over the last few months and then enumerate all the distinct purposes for which Alice is interacting with the bank and pull them up.

This is called “journey discovery,” a systematic mapping of all of a customer’s engagements—including actions, inactions and silence—grouped over smaller purpose axes, spread along the time axis and then nurtured by aligning them with the enterprise’s business objectives.

How To Walk the Journey Talk

- Map the customer journey. Get to a whiteboard or leverage a good journey mapping tool to map all of the experiences, engagements, interactions, emotions, etc., a customer may experience at various touchpoints in the customer lifecycle. Try to map the journeys like the branches of a tree, where each branch is quite detailed and has its own purpose, yet they all stem from a larger objective rooted in the current lifecycle of a customer.

- Stitch all transactions, events and engagements across multiple touchpoints and try to cluster them along the purpose axis. Journey discovery demands sufficient use of machine learning, deep learning and heuristics alongside proficient business know-how, as one needs to correlate seemingly different events spread over time and channels with deeply interwoven purposes.

- Nudge each of the micro-journeys toward the next milestones on their respective journeys. This is called “journey orchestration.” In a truly customer-centric approach, customer purposes are respected at face value and not prioritized based on enterprise objectives or profitability.

When nudges are aligned with customers’ purposes, they translate into desired business outcomes. Customer journey management helps large enterprises, such as BFSI and telcos, realize outcome-driven personalization. Recommendations are provided as long-term prescriptions tailored to help customers meet each of their purposes while aligning with the larger business objectives of the enterprise—not the other way around.

This article was originally published here.

]]>The “what, when and how” are essential ingredients of personalization. With continued investments in analytics and sustained leverage of machine learning (ML), modern telcos have achieved commendable success in deciding what best to offer (or not offer) to their customers based on their past behaviors and present context. Riding on sophisticated models that deduce the best time to intervene, taking into consideration user preferences, current context and macro influences, the “when” part is fairly addressed.

However, when it comes to the mechanics used to realize the full potential of personalization, telcos tend to lag behind considerably. Often, we are left with dull text messages or pop-ups with boring calls to action and highly predictable post-purchase notifications. There is no excitement left in making a purchase! This is when gamification can help solve this piece of the customer engagement puzzle and make everyday interactions more enjoyable.

What is gamification?

Back in 2002, Nick Pelling defined gamification as “applying game-like accelerated user interface design to make electronic transactions both enjoyable and fast.” In contemporary business terms, it is the application of game mechanics to nongame environments to motivate people, keep them engaged and instill desired behavior.

How can telcos leverage gamification?

Putting customers at the center of business operations and personalization as a major driver of customer satisfaction, telcos should look at gamification from the customer’s side, not the enterprise side. The question is not, “How do I use gamification to sell better?” Rather, it should be “How does gamification help me make my customer experiences better, more engaging, more meaningful and more rewarding?”

Riding on the learnings from how other verticals, including retail, have leveraged gamification, telcos should open up and consider broader adoption outside of just loyalty. They need to use it effectively for the following.

- Information Seeking: Zero-party data is information that a customer intentionally and often proactively shares with an enterprise. Instead of asking users to fill in their details in a form, telcos may partner with fantasy gaming portals and offer them a pass to a “treasure hunt” game in which they get to unlock various tools in return for their information. From the immense data that a telco possesses, they know when Tom is free and possibly growing impatient in a slow-moving taxi (from location, maps and browsing activity), and at that point in time, if he is offered something interesting, there is a high chance he will engage with it, yielding a win-win situation.

- Ego Stimulation: Everyone likes recognition, and perhaps no one likes losing it. In response to Alice’s sixth consecutive on-time payment, instead of sending her a routine “Thank You” message, a telco can easily send her an animated digital greeting that emphasizes how valuable she is. Or what if there is also an embedded “spin the bottle” game with humorous rewards?

Yet again, personalization holds the key. Whereas luck-based games like scratch cards or dice rolls appeal to some, knowledge-based games like guessing the image or predicting what is next interest others. And skill-based games like puzzles or spot the differences might attract someone else. Investing in easily embeddable games with leaderboards, badges and other means of recognition could help telcos keep customers engaged.

- Delighting Customers: Information is addictive. Telcos can offer gamified anonymized insights such as the number of people with similar interests within five miles or the top 10 game leaders in the user’s area. Although this may sound irrelevant to certain people, there is certainly a large pool out there who like to keep track of such stats.

Why should telcos embrace the change?

Given the abundance of behavioral data they have at their disposal, telcos may also use gamification to empathize with the customer. If Bob was streaming late-night soccer finals and he quit at a point that happens to be at the brink of when a good number of other streamers quit, ML can easily predict that was perhaps the repercussion from a low moment in the match during which many desperate fans logged off. In response, it may send a quote or inspirational digital greeting to Bob highlighting instances in which his team has bounced back hard.

About a decade ago, some of this might have sounded like a fanciful tale or wishful thinking. But given contemporary advances in data processing capabilities at scale, the maturity of AI and ML and a greater focus on personalization, some of these scenarios are easily within telcos’ reach.

Telcos should stay up to date with their personalization efforts and consider expanding their budget allocation for gamification to strengthen any weak links in the customer experience. Gamification, when applied the right way across all stages of the customer life cycle, can help telcos regain lost mindshare while also making day-to-day otherwise mundane interactions and experiences more engaging and interesting.

This article was originally published on Forbes.

]]>

As the pandemic has shifted gears on customer behaviour, people are becoming more accustomed to a new way of customer experience. Labelled as an essential service, telecom operators though already aware, realised the heat of evolving mindset during the pandemic. Today’s consumer expects and entertains only value-driven interactions from their service providers. To give you a view of the situation, the customer churn doubled for telcos in India in Feb’21. Every communication must be personalised, customised to their need. Not only this, customers expect businesses to anticipate their future needs and offer contextual, relevant and timely solutions.

This blog highlights some intriguing learning shared by the speakers.

Highlight 1:

Scale is significant for telecom operators as it adds another dimension to the problem of hyper-personalisation in the telecom industry. Personalisation is the default standard for engagement for web, mobile and in-person interactions and telcos can’t rest on past laurels.

Highlight 2:

Research shows that 1/3rd of consumers expect brands to deliver personalisation, and if failed, it’s easier for them to switch brands. Three-quarters of customers switched to a new store, product or buying method during the pandemic. To counter this, telcos can design multiple micro yet thoughtful customer touch points. Something as simple as the relevance of offers, post-purchase checking, and sharing ‘how-to videos to show that the brand care for its customers.

Highlight 3:

There is already a felt need for personalisation in the telecom industry. A normal customer who is exposed to the personalised experiences delivered by the likes of Google or Amazon wonders why their telco, despite having access to all the relevant data about them, is not able to provide a hyper-personalised experience.

Highlight 4:

Companies who opt and invest in personalisation solutions can generate 40% more revenue than others and increase the CLV by 35%. McKinsey research shows that telcos have the potential to generate around $200 billion in value from personalisation alone in the next few years. Telcos must be invested in hyper-personalisation to make the most out of this opportunity and ensure they keep benefiting from future technological innovations.

Highlight 5:

Telcos today must live up to the expectations of dynamic and evolved individuals and plan every single interaction based on subscriber requirements and preferences. Telcos need to consider the behavioural aspect and the context at an individual level. That’s where hyper-personalisation empowers telcos to connect with subscribers in the most authentic way via a value-driven interaction.

Highlight 6:

Things previously rendered impossible became possible during the big data era when telcos started investing in data marts and building aggregated personal customer profiles. Telcos created 100% telcos-centric customer profiles but were completely blindfolded by customer engagement with other dimensions of their life. Then followed the OTT or digital era when the likes of Netflix and YouTube started gaining a mind share. New channels like WhatsApp and Facebook began to replace long-proven and legacy channels like SMS. This was the time telcos started focusing more on AI/ML.

Highlight 7:

Location intelligence was the buzz word during the personalisation era, and almost every telco attempted and achieved different levels of success. The focus was to reach out to the customer in the most relevant manner, but for the offer that the telco wanted to sell. Next is the hyper-personalisation or individualisation era, where telcos are reaching out for customers’ felt needs and not necessarily for what the telcos have to sell at that particular time.

Highlight 8:

Personalisation was essentially a way to be more relevant in customers’ minds. But telcos have their own challenges, starting points, contexts and possibly different literacy levels on their customers. So, if telcos have to take on a sustainable approach to hyper-personalisation, they need to stay invested in it, take the best practices and mould them as per their needs. Success calls for a personalised approach to personalisation, and the prescription varies from one telco to another.

Highlight 9:

Almost 25% of telcos globally are just starting their journey of personalisation. Even within the operators who have initiated pilot projects, many are yet to scale their projects to realise the full potential of hyper-personalisation. In fact, very few telcos are using data analytics and AI/ML to its full potential.

Highlight 10:

Telcos are still experimenting with the idea of hyper-personalisation and are inspired by the success it has delivered for other industry verticals. It has increased the experiment appetite for telco marketers, but to achieve the full potential of hyper-personalisation, telcos need to do the following with agility and speed-

- Recalibrate their Customer Value Management

- Take a leaping stride in mapping 100% of customer’s touchpoints

- Invest in the right Martech partner

- Streamline their operations

Want to watch the full webinar. Click Here

]]>Amazon gets almost 35% of its revenue by engaging its customers through a recommendation engine. Netflix recommendation engine also generates over USD 1 billion per year in revenue. Many businesses have scaled their customer engagement to new heights that transformed into business benefits. But we do not hear a similar success story in telecommunication. Why is it so?

Despite access to the largest pool of customer data compared to any other industry, Telcos tend to be unsuccessful in capitalising on it to enhance customer engagement.

They struggle with low engagement, depleting revenues, and high churn. There have been investments in customer engagement solutions, techniques, talents and strategy, yet there seems to be no end to their misery. So, what is stopping telcos from becoming customer-centric and meeting the dynamic digital-first customer demands?

Where telcos missed taking the right turn

Unlike the digital natives, Telcos found it difficult to phase out the traditional approach as they are heavily invested in legacy systems and traditional processes, so it becomes difficult to break the chain. There have been some progressive investments in data lakes, enterprise-grade software, new age OSS/BSS, but customer-centricity still lacks the required focus. To achieve this transformation, there is a need to bring in a customer-centric solution like customer engagement hubs. Telcos are still using multiple poorly integrated systems to perform a task end-to-end. Telcos use different solutions for customer analytics, campaign planning, campaign intelligence, NBO. Lack of data sharing and reconciling capabilities among these systems lead to the half-baked output. Also, the time lost in the lengthy process delays decision making and poorly designed campaigns. Today’s customers are impatient, demanding and want a holistic, integrated experience specially designed to suit them. Achieving this is not impossible, but telcos need to plan and act accordingly.

Why telcos must invest in the right customer engagement hub

A Customer Engagement Hub is an important element to strengthen the value chain that can transform the telco-customer relationship and directly impact the bottom line. Gartner defines Customer Engagement Hub as an architectural framework that optimally ties multiple systems together to engage the customer. It allows personalised, contextual customer engagement across all interaction channels, whether through a human, artificial agent, or sensors. It helps create an integrated customer experience by connecting multiple siloed functions for a seamless experience.

Customer engagement hubs help fulfil customers’ demand for more personalised, seamless experiences. Customers demand an integrated, seamless experience as they switch between different channels during the purchase journey.

Salesforce’s recent research shows that 75% of customers expect seamless interactions across different departments. 54% of respondents say sales, service, and marketing don’t seem to share information; 83% of customers expect immediate resolution when they contact a business.

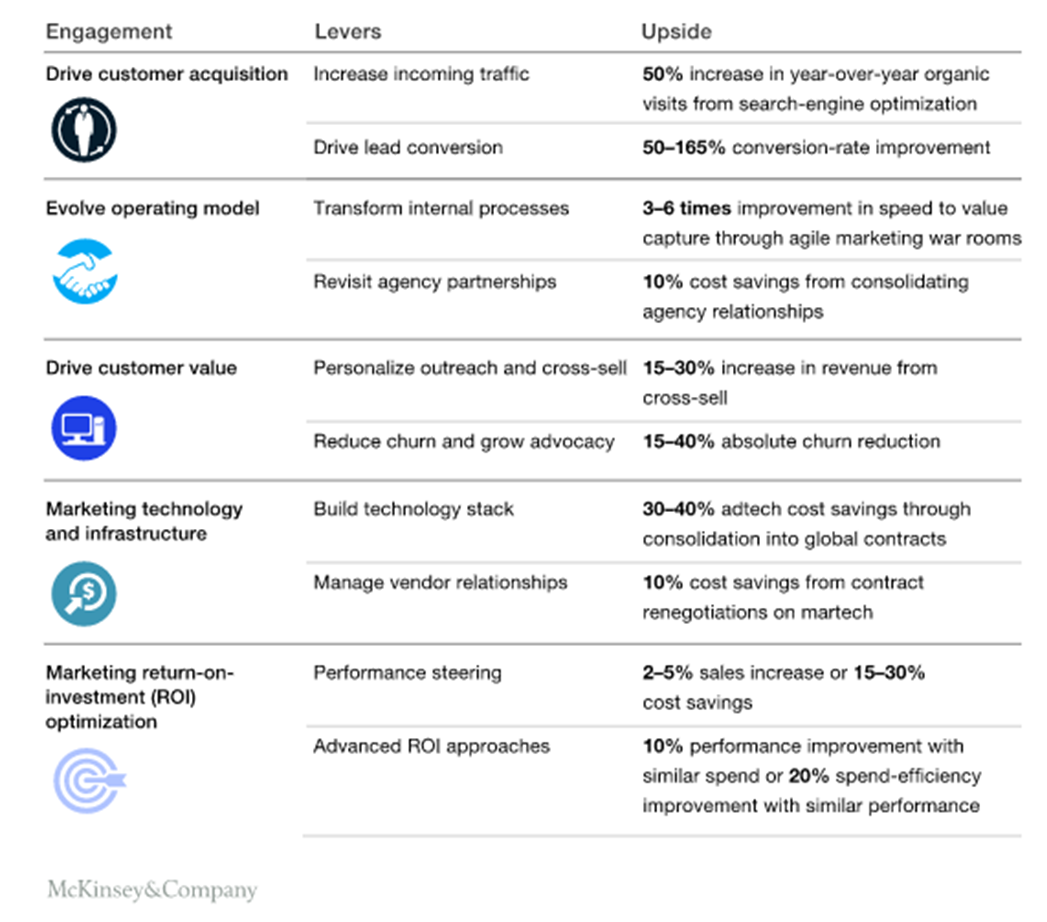

As per Mckinsey, operators that have advanced their digital customer engagement will experience the most significant upside.

How to check if your customer engagement hub is the right fit for you

In today’s context, the most important thing is to offer an end-to-end capability for telcos to manage the entire customer engagement from one platform. This reduces operational cost; centralised data access minimises the time for analysis; enable real-time decisioning. Cost-benefit and reduce operational overheads as the operator is just managing a single vendor. Advanced self-servicing AI/ML-driven capabilities to allow business teams to run the platform without any dependency on the technical teams. This is a great capability to promote the citizen data scientist model to create a data-driven organisational culture. Real-time decisioning and execution help telcos in highly personalised, contextual and value-driven interaction with customers.

Easy integration with different systems (upstream and downstream) through APIs. This enables easy data sharing and has a single view of the entire organisation. You can collate diverse customer data points to create a 360-degree customer profile to help you run a segment of one campaign.

Here is a case study of a leading telecom operator that saw significant revenue impact and churn reduction by migrating their legacy systems to Pelatro’s MViva Customer Engagement Hub.

About Pelatro’s MViva Customer Engagement hub

Pelatro mViva Customer Engagement Hub offers an end-to-end solution that creates a foundation for delivering a better, more informed customer engagement experience. It provides clear visibility into the customer’s entire relationship with the telecom operators and enables the marketing teams to be more effective. You can engage the customers at a more holistic level, considering their past interactions, behaviours, needs, and other aspects.

Interested to see a demo of mViva Customer Engagement Hub? Click Here

]]>Product innovation has long been the key focus for telcos to entice new customers, engage the current ones and bring in the additional revenue to keep the growth momentum going. But it has run its course with the democratization of technology, and there is a dire need to shift the focus now to other growth providing areas. The telecommunication industry is not known for its customer-first nature, but as customers become more digital savvy, that notion is changing. In fact, improving the customer experience is one of the top strategic priorities for telecom operators.

As other telco starts offering similar products, product innovation will no longer bring in the required business growth. Customer experience is one area where telcos try to set themselves apart from the competition. It can help them improve the subscriber acquisition, enhance subscriber engagement, reduce the churn and eventually acquire a larger market share.

Innovating customer experience can help telcos gain the upper edge

Customers want to see value in every interaction with the service provider. They expect telecom operators to understand their needs and wants, what they like and serve them as an individual and not as part of a group. Telcos need to increase the perceived value of every interaction with their subscribers that translates into higher ROI for both. Customer experience has been intertwined with every other function across every customer touchpoint. Improving customer experience can help telcos significantly improve brand loyalty, reduce the propensity to switch to a competitor and increase the CLV.

Contextual marketing to deliver the innovation in customer experience

Knowing what your customers want is not enough; knowing the context is crucial. If you are not able to deliver the right offer when they need one, it holds no value later. Therefore, telcos need to create a value exchange in every interaction with their subscribers by shifting from product-centric campaigns to value-based campaigns that are contextual and real-time. A comprehensive campaign management solution with the ability to plan and execute contextual campaigns can help them deliver these value-driven customer interactions.

Many vendors are developing innovative features in their contextual campaign management solutions with real-time data ingestion and analytical capabilities for real-time and contextually relevant interactions. It can enable telecom operators to focus on individuals rather than on a segment with a hyper-personalized approach. And dynamic content optimization can provide fine-tuned offers and promotions that can positively impact customer experience. Rather than just another sale, contextual marketing can make customers feel important and valued, leading to increased trust and stronger

brand loyalty.

Replace product-centric campaigns with value-based exchange with customers

The evolving consumer behaviour has shifted the telco mindset about engaging with their customers. This has made the role of a marketer more exciting and complex at the same time. Value exchange means designing your offers or promotions as per the needs and wants of the customers. Value exchange campaigns combined with context and run in real-time can deliver the best experience and RoI.

A subscriber with higher data usage and inclination towards sports events can be offered customized data bundles before an upcoming sports event. This contextual interaction or value-based exchange increases your campaign success, leading to a positive customer experience and higher revenue. Your traditional upsell, cross-sell, or acquisition campaigns will always exist, but the value will come from contextually orchestrated relevant interactions to address your customer expectations, and that’s the innovation we are talking about.

“Marketing

is the distinguishing, unique function of the business.”- Peter Drucker

The responsibility lies on the marketer’s shoulder. They are the guiding light in the sea of offers, packages and plans. As customers move towards a more digital experience, marketers need to look for avenues to create a better customer experience. Marketers have multiple tools at their disposal to help them create an experience for their customers that no one can replicate.

Is your campaign management solution helping you innovate your customer

experience?

As we mentioned earlier, vendors are building new capabilities in the campaign management solution to help telcos with real-time decision making. A solution that can help you with contextually relevant and real-time interactions with your customers based on in-depth data analysis will go a long way to improve your campaign efficiency and outcomes. Having a 360-degree view at the subscriber level helps you understand their usage pattern, behaviour and plan N=1 or segment of one level campaigns. Many OTT or eCommerce companies use DCO or dynamic creative (or content) optimization to place creative/content based on customers’ historical data and behaviour analysis to prompt viewers to take action. An advanced Campaign management solution enabled with artificial intelligence or machine learning capabilities can power marketers to plan and promote offers with higher uptake in real-time.

Learn about mViva Contextual Customer Engagement hub.

]]>

The first few steps to take

With their divergent data sources, telecoms that welcome data monetization will remain profitable and gain an edge over their competitors in the future. But, before that, here are some of the few steps that they should take before making data monetization as their core strategy. These steps should be to:

Make Sure Data is and aggregated and anonymized

The customer data needs to be structured and legalized before presenting it to the external enterprises. The most-advanced operators are working on outsourcing services that offer data monetization solutions that can manage compliance and regulatory requirements of data.

Understand What Competitors are Doing

This might sound too generic, but before telcos start working on their data monetization strategy, they should understand what exactly their competitors are doing and how! Understanding what competitors are doing in the market can create a lot of difference in building the right monetization strategy.

Enrol a specialized technology partner

To analyze what benefit data is bringing to the business, telcos need to partner with a diligent technology partner who can work on data, the right way. For example: if a telco manages to gain insights on people’s movement with the help of the solution that can gauge and collect data, they can even guide retailers on where and how to position ads and promotions to gain the maximum commercial benefits.

What is the way forward?

Undeniably, data monetization provides a brand with the ability to understand its business and customers while improving their decision making. With new trends revolving around digitalization and AI, 5G, and the IoT, telcos must figure out ways to build effective monetization strategies and know just how the growing market will use their data in the time to come.

One way is by providing ‘partner services’ to third party enterprises to execute personalized campaigns based on insights generated from the high-value customer bases. They could make it easier for enterprises to sign up and perform micro-segmentation using hundreds of both telco and non-telco parameters. Telcos could also support third-party companies in reaching out to a particular potential customer before a competitor does.

In summary, telcos can play a much more significant role in their customers’ digital lives and capture value for themselves as well as the third-party enterprises along the data monetization journey.

Pelatro’s mViva Data Monetization Solution (DMS) presents an opportunity for the Telecom Marketing teams to monetize customer data by easily signing up and charging the EPs (Enterprise Partners). The solution even enables telcos to partner with B2C entities to send campaigns and promotions in a targeted, real-time, contextual, and relevant manner.

]]>Telcos have a veritable pool of customer behaviour data, probably more than any industry. The massive gold mine of data includes Internet usage, location, behavioural and buying patterns, app and OTT consumption, roaming usage, travel patterns, and much more. In addition to customer-related data, Telecom industries harbour network and operational data. Though many major telecom players have already been implementing this data to gain insights about their own organization in order to improve sales and customer experience, boost marketing strategies and optimize network performances, there’s still a lot they can do with the opportunities provided by the vast data pool.

Out of several other lucrative opportunities sourced from data, telcos can now entirely focus on creating new revenue channels by simply monetizing it. Over and over again, technology leaders have said it, “data monetization pays off’’ if done right. However, not many operators have treated data monetization as a revenue channel because they face multiple challenges with regards to finding the right technology partner, getting the right choices from ever-evolving options, and implementing the right operating and governance models to foster the right data monetizing decisions.

So, despite these conundrums, is there the best reason to monetize data? To become more convinced with the idea of why data monetization is essential for telcos, check these key findings.

Key Findings:

As the globe shifts towards the Internet for every mobile service, with carriers forming the central part of the mobile economy, telecom operators must find newer ways to be ahead of the game by adopting data monetization strategies. Here are some of the crucial findings to support the fact about why every telecom operator should think about data monetization as one of their revenue streams.

● According to a study by GSMA, the mobile ecosystem revenue is forecasted to grow to nearly $3 trillion by 2020.

● According to the same study by GSMA, 5G technologies are expected to contribute $2.2 trillion to the global economy between 2024 and 2034. Key sectors such as manufacturing/utilities and professional/financial services will benefit the most.

● As per a research report by Ericsson, the data traffic per smartphone will grow to 10 times than its current volume by 2022.

● As per Research and Markets, the total global revenue being generated by Telecom API will reach a massive $319.6 billion by 2023.

● According to industry analysts, the $500Bn Content / Advertising market is eager to get customer insights to generate higher conversion rates with more contextualized advertising.

Why should telcos approach external partnership models and leverage data to boost profitability?

Telcos’ data monetization journey is not a recent trend; it began in early 2000 with their own strategies to develop business intelligence capabilities to generate insights from raw data. And only in the recent past telcos have built strong external partnerships with third-party enterprises to leverage data for creating innovative offers and services for customers. Data has become more structured with AI, and data quality has improved significantly, leading to refined customer databases now. These customized and refined customer databases can be bought by third party enterprises to create custom-made products and offerings.

For example, the Telecom Marketing teams can easily monetize customer data based on location by partnering with retailers and sending campaigns and promotions in a targeted, real-time, contextual, and relevant manner. In many cases, operators can implement data monetization to develop localized pricing, area-wise offering, individual plans, and much more in real-time service offerings.

Telefonica is one of the major telecom brands engaged in multiple collaborations with big brands such as Heineken, and United Colors of Benetton. In 2017, this operator acquired Statiq-a leading UK geolocation data start-up. Statiq processes plethora of location data signals to identify the places people visit and build consumer profiles. This helps advertisers to better target ads based on a user’s physical location and track whether they visited a retail store after seeing an ad.

Other monetization opportunities include partnering with advertisers and travel industries that use location data to personalize offers when customers are in that geography. Enterprises are also looking at ways to use customer data to incentivize, reward, and promote services to their existing customers. They are looking at ways to manage real-time campaigns without having to grind to get customer intelligence. Besides, these enterprises want to deploy data-led loyalty programs as a part of their marketing strategy targeted towards customer retention. And, if Telcos could take advantage of these requirements by making it convenient for businesses to connect with their customers using data, then it is quite probable that data monetization will essentially become a part of their long-term success story.

But what is stopping these carriers from helping them realize the true potential of data monetization?

Challenges lurking around data monetization

Several telecom players have invested in ‘analytics and AI’ as a part of their core investments. However, the results and benefits have not been fruitful, which is why telcos are still reluctant to do full-fledged monetization with data. Here are some of the challenges that are stopping telcos from harnessing value from data monetization investments.

Data Privacy

External data monetization strategies draw attention to one of the significant risks of data handling, i.e., – privacy breach. Data privacy is a growing cause of concern for many telcos, as well as national security organizations. However, many efforts have been executed by these organizations and telcos to build robust security around data privacy. Owing to the host of regulatory and compliance involved in sharing data, telcos often find themselves in a tight spot as they need to get proper legal consent from users/subscribers and anonymize and encrypt the data before using it.

Simpler and user-friendly tools

While the opportunities lurking around monetization is vast, adopting a suitable and easy product or framework to extract actionable insights is hard. Lack of user-friendly tools and techniques for analyzing data to send targeted and contextualized offers to customers have put telcos into dilemmas of whether to invest in data monetization or not. Despite having a myriad of options to pick from, many of the operators struggle to find a single solution that can do the job of both extracting data and using the insights to run personalized campaigns. Besides, without having a tool that’s easy to use for third party enterprises, data monetization may not prove useful in the longer run. Needless to say, the right solution should enable telcos to partner with B2C entities to send campaigns and promotions in a targeted, real-time, contextual, and relevant manner, without any trouble while onboarding enterprises.

High-Value Identification

No organization can start execution of data monetization strategy without knowing what kind of data can generate value chain opportunities. The data presented to the operators, and beneficial to various businesses, is in raw form, and is not structured the way most telcos want it. And, the most critical factor in data monetization lies in the cleansing of data to understand what value each customer or subscriber brings, and glean insights on customers that have the best value creation potential for the operator and the partnered enterprise.

The first few steps to take

With their divergent data sources, telecoms that welcome data monetization will remain profitable and gain an edge over their competitors in the future. But, before that, here are some of the few steps that they should take before making data monetization as their core strategy. Telcos should aim at ensuring that they are playing a significant role in their customers’ digital lives and capturing value for themselves as well as third-party enterprises throughout the data monetization journey. The litany of challenges and steps associated with the implementation of the right monetization strategy will not end here. Follow PART 2 of this article and learn what it takes to bring data monetization to life across Telco’s growth pillars.

Pelatro’s mViva Data Monetization Solution (DMS) presents an opportunity for the Telecom Marketing teams to monetize customer data by easily signing up and charging the EPs (Enterprise Partners). The solution even enables telcos to partner with B2C entities to send campaigns and promotions in a targeted, real-time, contextual, and relevant manner.

]]>